City leaders allocate $27M while addressing public concerns

Elgin City Council convened for a special session Sept. 26 to decide the fate of next year’s fiscal budget and its impact on local taxpayers.

Following public outcry from concerned residents and an appearance by State Rep. Stan Gerdes during the Sept. 17 meeting, the council agreed to table the proposed $27 million budget and tax hike vote. They decided to hold an additional workshop to explore all possibilities and ultimately set the total tax rate at 57 cents, a reduction from the 59 cents approved in the first budget reading and the 62 cents authorized by the state legislature.

“The way that the property tax system works in Texas is that the city government has very little, frankly, control or impact over the tax bills that we pay,” City Manager Tom Mattis said. “We only represent a very small percentage of that, and as far as the system goes, the city has no control over valuations, no control over collecting taxes and no control over ensuring that tax appraisals are equal and uniform. The only thing the council can do is set its tax rate.”

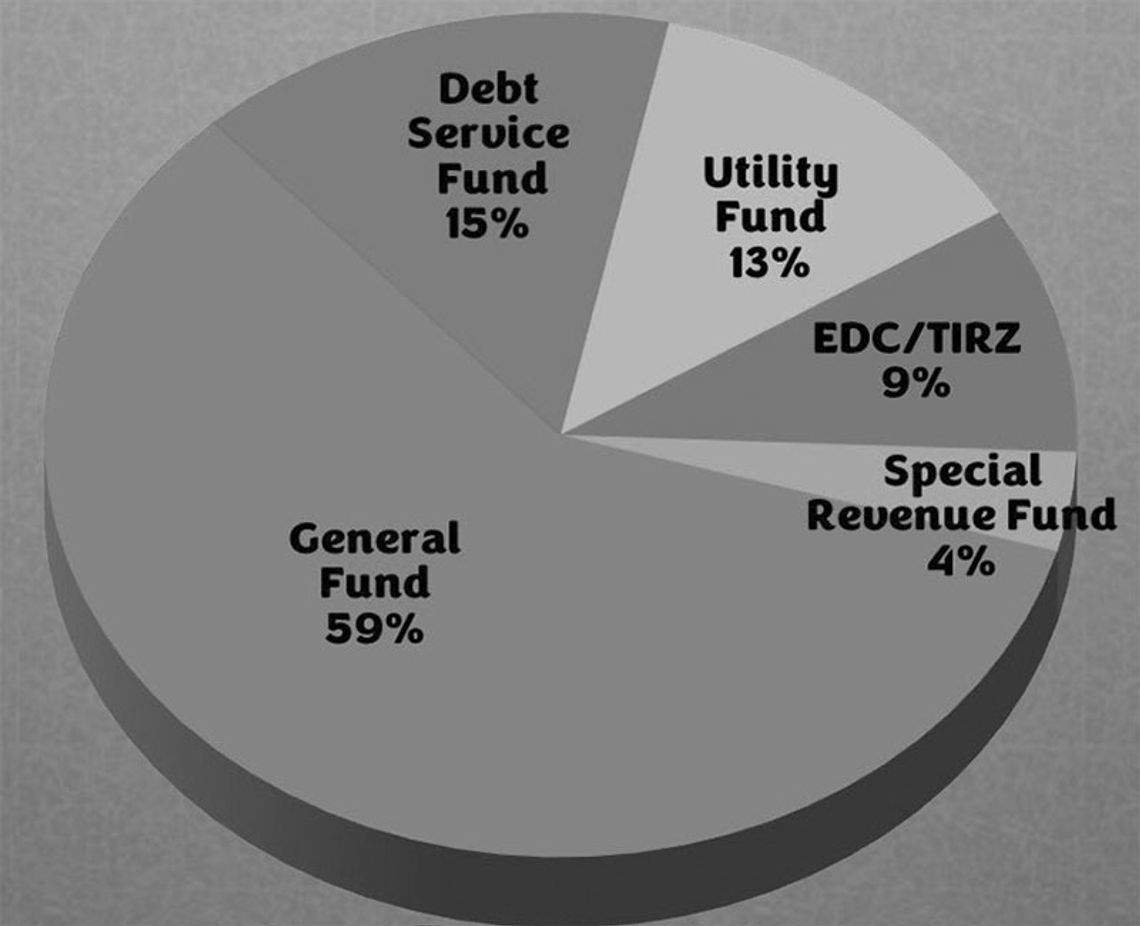

Mattis described the proposed budget as a zero-based, balanced financial plan where all operating expenditures are supported by revenue generated during the fiscal year. He noted that growth has bolstered this effort, particularly through increased general fund revenue from development services fees and the steady rise in property tax values.

However, Mattis cautioned that indicators suggest “this may be a moderate year for financial growth, not what we’ve experienced in the last few years.”

Elgin’s overall taxable revenue has decreased by 13% due to a $15,000 annual exemption and tax freeze for seniors adopted last year, contributing to the increase in the tax rate necessary to balance the budget, according to the council.

To achieve a 3-cent cut in the tax rate, the budget faced a $300,000 impact on its general fund. As a result, two of the four new positions — a program assistant and a maintenance technician — were removed, along with funding for sidewalk repairs. Funding for a lieutenant and sergeant in the Elgin Police Department remains intact.

“I feel compelled to say that from a staff perspective, these general fund positions that are predicated on the 59-cent tax rate, we believe are vitally important for the operation to continue meeting service demands from the public,” Mattis said. “If we don’t have these positions, we can’t keep up the same service level that we established in the past. Elgin isn’t about staying still. Clearly, our service demands are growing. We’re in the service business; we provide services through having well-qualified and well-compensated staff, and we want to continue that moving forward. All four of these positions are responsive to city council priorities previously stated.”

With the cuts, a home valued at $300,000 will save $86 in property taxes for the year.

In addition, many departmental requests and programs will see their annual funding increases reduced from the growth patterns observed in recent years. Notably, there is no pay increase for Mayor Theresa McShan or council members in the budget, nor is there funding for emergency medical services, vehicles, equipment or city-funded street improvements.

While further street improvements will occur, they will be funded entirely by private developers, according to Mattis.

The council remains optimistic that revenue could exceed projections, and staff will continue to monitor the situation. If revenue flows stronger than anticipated by mid-fiscal year, the council may be asked to consider amending the budget to fund programs and projects not currently included.

Mattis defended the original 59-cent tax rate, stating that the city has adhered to the Texas legislature’s directives in its calculations.

“The system is not fixed, in spite of suggestions by some,” he said. “It’s their system that calculated the tax rate that enables us to go as high as 62 cents. If we’re trying to really understand where the problems are with the tax system, understand that the legislature has specifically dictated this process that we follow.”

According to the council, the average total property tax rates of neighboring municipalities hover around 62 cents. Mattis explained that the city receives a very small portion of its taxes — approximately 23 cents of every property tax dollar paid.

“I think another thing that we need to keep in mind is why we feel like we pay a lot of taxes in Elgin,” he said. “It’s important to understand that the city receives a very small percentage of those taxes.”

Mattis also addressed Rep. Gerdes’ comments about the budget’s nonprofit funding, which he referred to as a “slush fund.”

“This is not a slush fund; the city doesn’t have slush funds. The state may have slush funds, but the city doesn’t,” he said. “This may be one of the most important decisions the council feels they make from year to year.”

Community nonprofit funding supports local organizations such as CASA, Elgin Alley Cats, Elgin Juneteenth Organization and Relay For Life of Elgin — all of which received less than requested for fiscal year 2023-24.

“Every year, this sheet is indicative of the fact that we receive way more requests than funding,” Mattis said. “This is the kind of investment that the council makes on behalf of the public, using tax dollars to support these organizations doing great work in our community. It’s something important that we do; I really resent this being called a slush fund. If you’re part of one of these organizations, you know these donations are essential.”

Over the past nine years, the city has shared over $300,000 in support of various organizations, according to the council.

The council made it clear during its presentation that all changes to the budget are a direct response to Elgin’s unique situation and its unprecedented growth.

“Effectively responding to the growth of the Elgin community has been the central issue in nearly all deliberations of the council and staff in recent years,” Mattis said.

The report stated it took Elgin 145 years to reach a population of about 8,000, but the town has doubled in size over the last five years. On average, the Elgin community has seen the equivalent of one new house built every day since 2019.

“That’s a lot of growth — a huge challenge for any city to accommodate and keep up with,” Mattis added.

Around 70% of future growth will occur in Extra Territorial Jurisdiction Municipal Utility Districts, where the city provides no services, according to the city manager.

“Everything new happening in the MUDs — those developments and the people buying homes there — are the ones paying for that. City taxpayers don’t pay anything for those facilities,” Mattis said.

The council expressed confidence that there are no major city infrastructure issues related to transportation, water or wastewater. Mattis stated their goal is “to provide the best services for the most, not for every individual in town, not for every individual home. Our objective as a city government is to provide the best services for the largest number of people.”

These developments will generate additional tax growth for schools, public safety and the county to provide services.

When it came time for the final budget vote, council members sought further clarification on the new police positions, but Mattis declined to provide more details at that moment.

“We’ve answered every question, I’ve responded to every email, and answered every question we’ve received. We’re literally on the last day of the budget. It’s time for the council to vote on what you want to do. This is the kind of question that could’ve been asked six weeks ago,” he said.

Councilperson YaLecia Love also pushed for further information but to no avail.

“Sometimes, when we ask questions, it’s not just for us, but it’s for the public to hear that,” added Joy Casnovsky.

In the end, the council urged the public to engage in governmental discourse earlier in the process.

“I just wanted to thank the public for engaging in the discussion,” said Councilperson Forest Lee Dennis. “We start this in August, and we have public meetings throughout. I think through a social media campaign, you were engaged late in the process, and it would be a lot less confusing for you if you were engaged earlier on.”

Council members Love, Al Rodriguez, Arthur Gibson and Matthew Callahan voted against the 57-cent total tax rate, favoring a 55-cent plan that did not receive majority support. The lower rate would have also eliminated the two new police department positions and alley renovations.

FY 2024-25 neighboring communities total property tax rates

• Bastrop – $0.49

• Taylor – $0.59

• Manor – $0.85

• Giddings – $0.70

• Smithville – $0.58

• Average total tax rate – $0.62

“I think through a social media campaign, you were engaged late in the process, and it would be a lot less confusing for you if you were engaged earlier on.”

— Councilperson Forest Lee Dennis

“The way that the property tax system works in Texas is that the city government has very little, frankly, control or impact over the tax bills that we pay.”

— City Manager Tom Mattis

.png)