A proposed $27 million annual operating budget for the 2024-25 fiscal year was presented to City Council last week, suggesting a moderate year for financial growth with a more conservative view of funds.

Designed to address both the city’s robust growth and its evolving fiscal needs, the proposal highlighted a property-tax rate increase, emergency medical service needs and a slight decrease in development appropriation.

City Manager Tom Mattis presented the detailed financial plan Aug. 13, developed through a comprehensive review of all existing programs, operations and services.

By state law, a budget must be in place by Oct. 1. More discussions are planned.

“The city has had some very healthy financial years in the last few, particularly driven by growth and development,” Mattis said. “Development services fee revenue has really supplemented the general fund and it’s enabled us to grow some of the services in a way that we wouldn’t have been able to otherwise.”

Responding to growth has been a central issue in council deliberations and city staff discussions in recent years, according to Mattis. Financial gains made through development services fees have previously bolstered the city’s general fund, but this year is expected to see a comparatively “down year” for these fees, despite ongoing development, officials The budget anticipates development services fees will come in about $1 million under last year’s predictions. The report noted the revenue doesn’t flow steadily, with developers sometimes paying many fees in one year, and not the next.

“The city’s commitment has always been that growth pays for itself,” Mattis added. “This issue has nothing to do with whether or not development is continuing, obviously it’s continuing. Building activity moves steadily along; it’s just the way the city receives these revenues is sporadic.”

Despite this downturn, the $27 million budget reflects a slight increase in overall appropriations from the previous year.

With nearly $16 million designated for general fund expenditures, the budget emphasizes public safety, public works and administration.

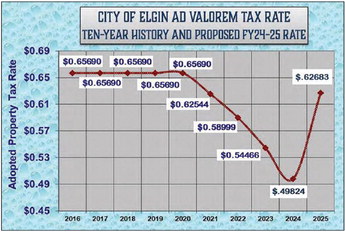

Budget calculations also suggest a 25% increase in the city’s property-tax rate, driving up the “voter- approved rate” by more than 12 cents. According to Mattis, the increase mainly stems from the city’s overall taxable revenue decreasing by 13% from 2023 to 2024.

“When you think about the growth and the development that’s continued during that year, I think it’s a fairly logical assumption that that means property was overvalued in prior years,” Mattis said.

Voter approved

The proposed annual budget is predicated on adopting the “voter-approval rate” property tax rate and represents a 3.5% increase in tax revenue.

Previously, the city has had success in managing its property-tax rate, which has decreased over the past four years. The report attributed the new warranted increase primarily to a state-mandated system.

“Even though we’ll make this jump of 12 cents, it’s still just going to put us back to where we were five years ago on our tax rate,” Mattis said.

In addition, sales-tax revenue is trending upward, according to the report. Projections for the fiscal year anticipate exceeding $4 million, marking a record high for Elgin.

The city imposes an additional 2% sales tax on top of the state’s 6.25% rate, a common practice for municipalities across Texas. Of this, 1% supports city operations, with the remainder going to Bastrop County and the city’s Economic Development Corp.

Big jumps

“In the last five years alone we’ve seen some really big jumps from year to year, all are a really good indication about how retail businesses are operating overall in the city,” Mattis added. “This continues to tell us that businesses are being successful.”

Emergency Medical Services were once again a focal point in the meeting, though the proposed budget does not currently include provisions for upgrades.

While it is presumed Bastrop County will continue to provide EMS at the same service level that exists today, the council is keen on significantly enhancing these services, officials said. Planning discussions have yet to begin on how the city would go about EMS improvements, but any significant upgrade in these services will come with a corresponding increase in costs, the report noted.

“After we get the budget done, that will be the first thing council will take on,” Mattis added. “We can jump right into this issue and figure out how we’re going to move forward. There’s a lot of decisions to be made, including just the first part about how we assess the options we have available to us.”

The budget is conservative in its approach, focusing on prudent financial management without cutting service levels or staff. This approach aims to manage financial uncertainties effectively and maintain service quality, allowing the potential for mid-year adjustments if revenue exceeds expectations, according to the proposal.

“Some of the revenue issues could turn around and have a more positive flow. If things are better than predicted at the midyear point, we can come back and see if we can add back requests that weren’t fit into the budget,” Mattis said.

The budget review process will include a council review Aug. 27, a public hearing Sept. 3, another review Sept. 10 and a second reading and final adoption scheduled for Sept. 17.

These dates will provide opportunities for public input and further council deliberations. For a look at the proposed budget, visit https://www.elgintexas.

gov.

.png)